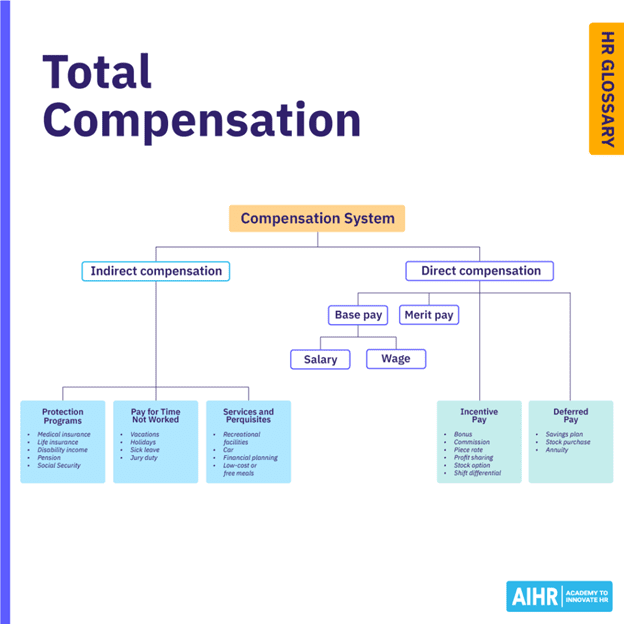

When most people consider their income, they usually focus on the number printed on their paycheck. However, your employer is likely to invest much more in you than just your base salary. From health insurance to retirement contributions, paid time off to professional development, these additional benefits combine to form your total compensation package. Understanding this figure is crucial for evaluating job offers, negotiating raises, and planning your financial future.

Source: Academy to Innovate HR

Base Pay

Your base salary or hourly wage serves as the foundation of your compensation. This is the fixed amount you earn for your work. If you’re salaried, your pay is straightforward; if you’re hourly, calculate your gross earnings (before taxes or deductions are taken out) by multiplying your rate by the expected annual hours.

Unlock Extra Value: Understanding Benefits

Many employers offer incentive pay in addition to your base salary, which can significantly increase your overall earnings. This type of compensation includes bonuses, commissions, stipends, and profit-sharing programs. For example, annual or quarterly bonuses are often linked to company performance or individual achievements. Commissions, commonly found in sales roles, reward employees based on the revenue they generate. Profit-sharing plans distribute a portion of the company’s profits to employees, fostering a sense of ownership and motivation. When evaluating your total compensation package, consider variable pay components, as they can significantly affect your annual income.

Benefits are often one of the most overlooked aspects of compensation, yet they can be worth tens of thousands of dollars each year. Contributions from your employer towards health insurance, dental and vision coverage, and retirement plans like 401(k) matches add significant financial value to your package. Paid time off, including vacation days, sick leave, and holidays, also holds monetary value since you continue to receive pay while not working. Additionally, government-mandated benefits, such as Social Security and Medicare contributions, should be considered, as they represent part of your employer’s investment in you. By assigning a dollar value to these benefits, you gain a clearer understanding of the true worth of your job beyond just your paycheck.

Beyond Salary: Perks

Employers increasingly offer perks that enhance work-life balance, including:

- Tuition reimbursement or professional development stipends

- Childcare subsidies or parental leave

- Wellness programs, gym memberships, or mental health support

- Transportation allowances or company cars

While these benefits may not provide immediate cash, they reduce your expenses and improve your quality of life.

Get the Real Value: Your Total Compensation Breakdown

To get a comprehensive view of your compensation:

- Start with base salary.

- Add any incentive pay.

- Estimate the annual value of benefits (insurance premiums, retirement contributions, paid time off).

- Add the monetary equivalent of any perks.

The sum is your total compensation package. You can also use tools like Salary.com compensation calculator or CalcXML’s total compensation calculator to crunch the numbers. By following these steps, you can clarify the total value of your compensation and make informed decisions regarding your employment.

The Power of Understanding Your Compensation Package

Negotiation Power: Grasping the complete picture of your total compensation empowers you to negotiate with confidence and clarity. A position that offers a lower salary but boasts a wealth of enticing benefits—such as comprehensive health coverage, generous vacation time, and retirement contributions—may hold significantly greater value than one that offers a higher paycheck without these perks.

Career Decisions: When it comes to evaluating job offers, having a clear understanding of the full compensation package simplifies comparison. You can weigh not only the salary but also the ancillary benefits, allowing you to make informed decisions that align with your career goals and personal values.

Financial Planning: A thorough understanding of your benefits package is essential for effective financial planning. Recognizing the true worth of your perks aids in budgeting for daily expenses and crafting a robust retirement plan, ensuring your financial future is secure.

Your paycheck is just the tip of the iceberg. By exploring the details of your total compensation package, you can uncover the true value of your employment. This comprehensive perspective allows you to approach your career and financial situation with greater insight and intention.

About Express Employment Professionals

Express Employment International supports the Express Employment Professionals franchise and affiliated brands, including Specialized Recruiting Group and Express Healthcare Staffing. The Express franchise brand is an industry-leading, international staffing company with franchise locations in the U.S., Canada, South Africa, Australia, and New Zealand.